RESEARCH: 4 equipment buying and selling trends every construction business should know

Ritchie Bros. recently conducted a survey, which sought the views, experiences and plans of over 200 construction businesses across Germany, France, The Netherlands, and the UK. The survey revealed 4 equipment buying and selling trends every construction business should know. Let’s dive in!

Gearing up for a 2021 boom

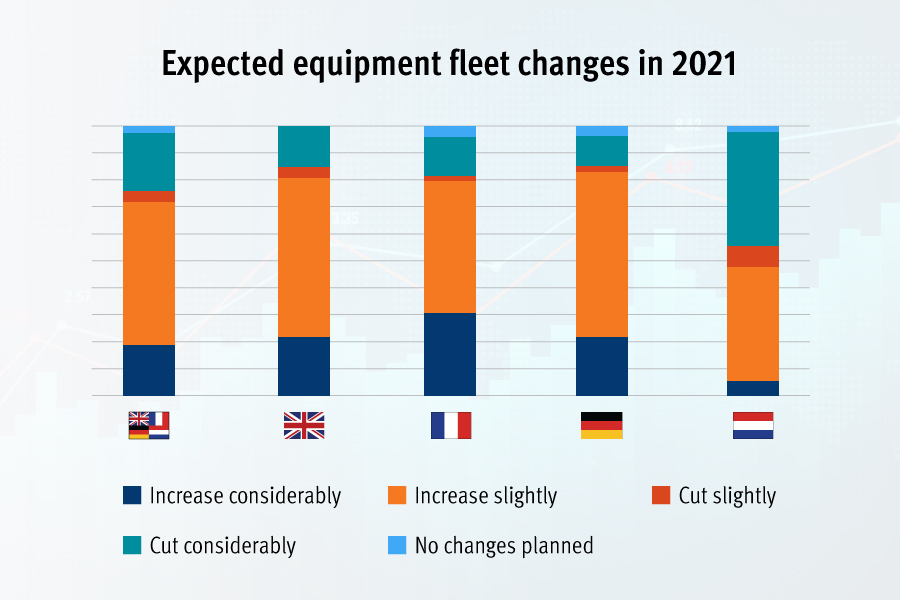

After a year of lockdown, inevitable productivity slumps and general uncertainty for the construction industry, companies are gearing up to make large equipment purchases and sales in 2021 as projects gather momentum and order books grow.

This trend was among the findings highlighted in a recent survey conducted by Ritchie Bros., which was held with over 200 construction businesses across Germany, France, The Netherlands, and the UK. The broad range of companies spanned fleets from 2-200 with revenue sizes ranging from €100,000 to €500 million.

A huge 72% of the surveyed respondents said they were looking to increase their heavy machinery fleets, with 19% of companies planning to increase their fleet considerably over this year.

1. In with the new and out with the old

Whilst many companies are planning these equipment shopping sprees, one of the top buying and selling construction trends indicates these companies are also looking to offload and replace equipment this year. A majority of 92% of the respondents planned to sell machines that were “too old.” Reasons for selling equipment included complicated and costly maintenance, especially among respondents from Germany, France, and the Netherlands where between 40-50% respondents cited this as a reason for offloading equipment to buyers, whilst 30% of the respondents said they would sell a machine this year “because it had not been used for some time.”

2. The growth of online buying and selling – a Covid-19 “digital legacy.”

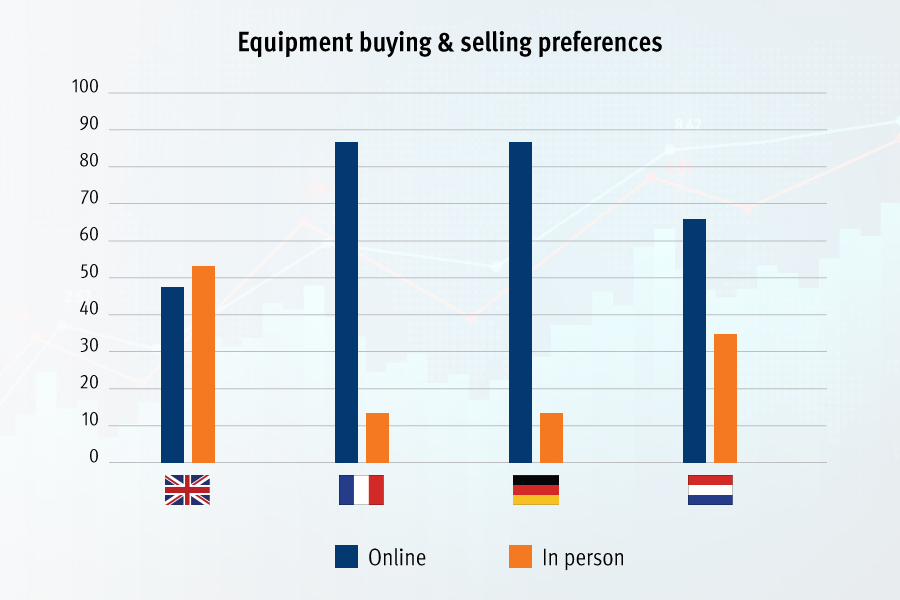

One of the Covid-19 pandemic’s main legacies for the construction equipment industry is the rising trend of online buying and selling.

A vast majority of 88% of all respondents when asked about top buying and selling construction trends stated they would buy at least some of their equipment online whilst a similar sized 84% of respondents planned to sell through online channels.

There was a strong feeling among the surveyed businesses that online buying and selling equipment is the way forward for the sector, with 71% of all respondents agreeing that online buying and selling of equipment is a suitable replacement for traditional methods. This sentiment was particularly strong in Germany and France, where 86% of the respondents from each region agreed that online buying and selling was a good replacement for traditional face-to-face options.

3. Fully integrated customer service still in demand

We know that despite the post-Covid-19 “digital legacy”, human connection is essential. There is still a market for traditional means of conducting business.

This was particularly expressed by UK respondents, where 53% favoured being able to buy and sell in person or have a physical location to handle their plant machinery transactions. In-person transactions were also favoured by smaller surveyed companies owning 2-3 items, where 92% still valued this means of conducting business.

This sentiment is recognised and embraced by Ritchie Bros. We know that whilst e-commerce has become the norm, especially over the past year, you can’t compare buying heavy machinery with a pair of shoes on your favourite website. We will always provide physical sites and offer a face-to-face service for our customers. Over the past six months, we have added smaller sites away from our main auction sites (i.e. in Germany and France) to give our customers the convenience of dropping off equipment without travelling from the other end of the country to sell units.

4. Making better buying and selling decisions with data

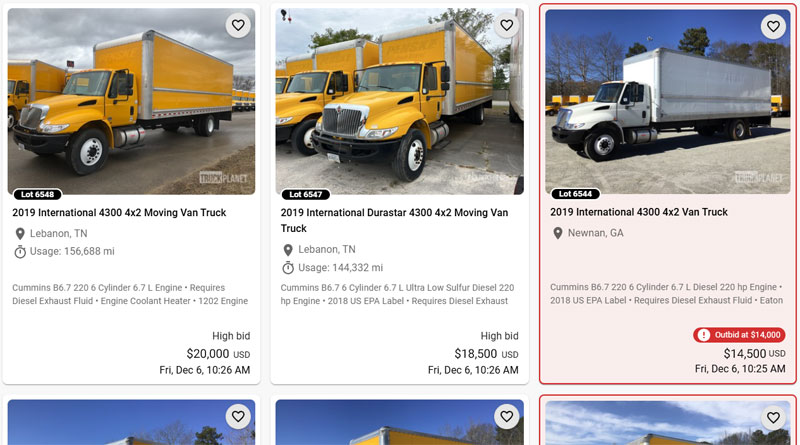

The growth of online sales has also led to increased demand for more instant information on equipment. Customers seek more immediate market data and target optimal time to make decisions on buying and selling equipment.

We have seen increasingly more interest from construction businesses looking for data intelligence to support their decision-making processes. They may have redundant machinery stored in their yard, facing the challenge of replacing older equipment with newer models. Ritchie Bros. can provide customers with data that identifies market rates for machinery – this includes brands, models, hours or milage and general condition to help customers make the right decision to get the best possible outcome for their business.

|

Exciting new features: Watchlist Carousel and real-time Timed Auction info |