Market Trends Report recaps Q1 2025 construction and transportation pricing and sales

With our recent edition, we are taking a broad view of construction equipment and transportation sales from Q1 2025 using the industry’s best data.

In the full report, we look at pricing and volume trends for most major construction and transportation equipment categories with both Ritchie Bros. auction data and Rouse retail insights.

Ritchie Bros. Auction Trends

Overall, auction pricing results are fairly mixed across both the U.S. and Canada when comparing median prices from Q1 2025 and Q1 2024. A few key highlights were:

- U.S. aerial equipment (boom lifts/scissor lifts) showed price stability.

- Prices in some categories are down, but largely driven by notable increases in age at sale and average usage.

- Generally, across the board sales volumes have decreased, driving stability and price increases in some cases.

Ritchie Bros. Mixed Adjusted Price Indexes

Construction prices in the U.S. were down in Q1 2025 compared to the previous quarter, while transportation prices were slightly higher versus Q4 2024. Both categories didn’t show much volatility in recent months.

In Canada, mean quarterly construction prices in Q1 2025 were lower than in Q4 2024, however there was a big jump in the last month. Transportation prices are slightly up over the same time period. Both construction and transportation have displayed notable strength through the early portion of 2025.

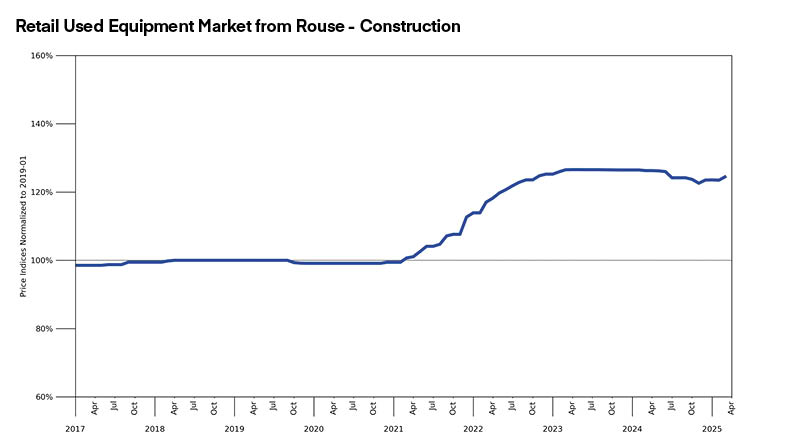

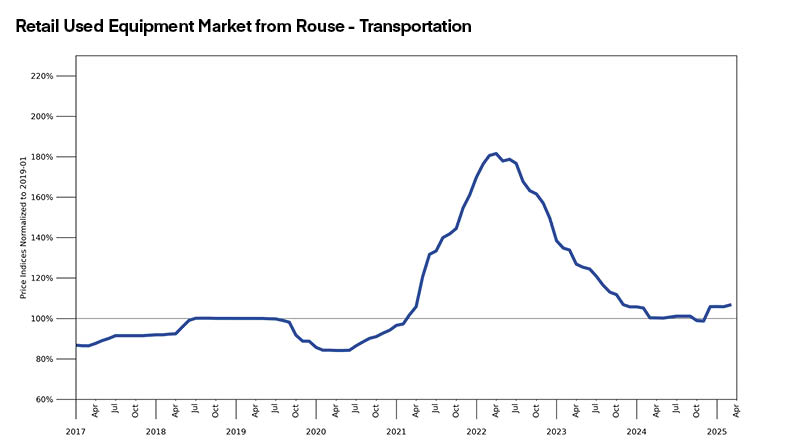

Retail Used Equipment Market from Rouse

Transportation prices in the U.S. have increased by approximately 3% from the last quarter (Q4 2024), while construction prices remained about the same compared to Q4 2024. Both categories have trended upwards in the last month.

Subscribe and download free Market Trends Report today

|

Understanding CDLs: Everything you need to know |